26+ non conventional mortgage

Web A nonconforming mortgage is a home loan that does not adhere to government-sponsored enterprises GSE guidelines and therefore cannot be resold to. Web A conventional mortgage or conventional loan is a homebuyers loan that is not offered or secured by a government entity.

Important Mortgage Terms Conventional Non Conforming And Conforming Loans Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Jumbo non-conforming Up to 1-2 million.

. Find A Lender That Offers Great Service. 3-5 minimum down payment. Apply Online To Enjoy A Service.

These include the conventional 97 loan Fannie Maes. Compare More Than Just Rates. Web The eligibility requirements vary for nonconforming mortgages depending on the loan type.

This type of loan caters to. Web A conventional mortgage is a loan thats not backed by the government. Ad Use Our Comparison Site Find Out Which Hpuse Loan Suits You The Best.

Web After reaching the 7 mark in early February the 30-year fixed-rate conventional mortgage is trading at 657 on Monday morning according to. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. A 620 minimum credit score.

Together we can go over your options and help. Being self employed history of bankruptcy unsteady employment. They are often compared to FHA loans.

Minimum credit score requirement of 620 Minimum. Web In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages. Web While riskier and less common than conforming loans non-conforming loans allow individuals to borrow larger amounts than is possible with a conforming loan.

Web Non-Conventional Loans Borrowers can be rejected for conventional loans for any number of reasons. Mortgages are how most people. Web Mortgage insurance is required for some conventional loans.

Highest Satisfaction for Mortgage Origination. Mortgage loan is currently 305000. Web Non-conventional mortgages are designed to help individuals with low to moderate incomes or individuals that require a low or no down payment.

Find A Lender That Offers Great Service. Web The average US. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Web Buyers with strong credit may be eligible for a number of loan programs that require only 3 down. Web If you have questions about conventional or non-conventional mortgages Lending Bankers Mortgage can answer them. Compare More Than Just Rates.

Thats less than half of the conventional or conforming loan limit of 726200 set by the Federal Housing Finance. Web But most conventional loans must meet basic guidelines set by Fannie Mae and Freddie Mac. Jumbo loan for amounts greater.

These loans have more flexibility but stricter qualifying requirements. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

Maximum 43 debt-to-income DTI ratio. Jumbo mortgages require a credit score of at. More on mortgage insurance.

Web In general to qualify for a conventional loan youll need. These rates assume you have a FICO Score of 740 and a down payment of at least 25 that the loan is for a single.

Are Conventional Loan Rates Higher Than Other Mortgages Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Non Conventional Mortgage Moneytips

July 26 2021 Esipitch

Non Traditional Mortgage Options In 2021 Mashvisor

What Is A Non Traditional Mortgage Loan Banks Com

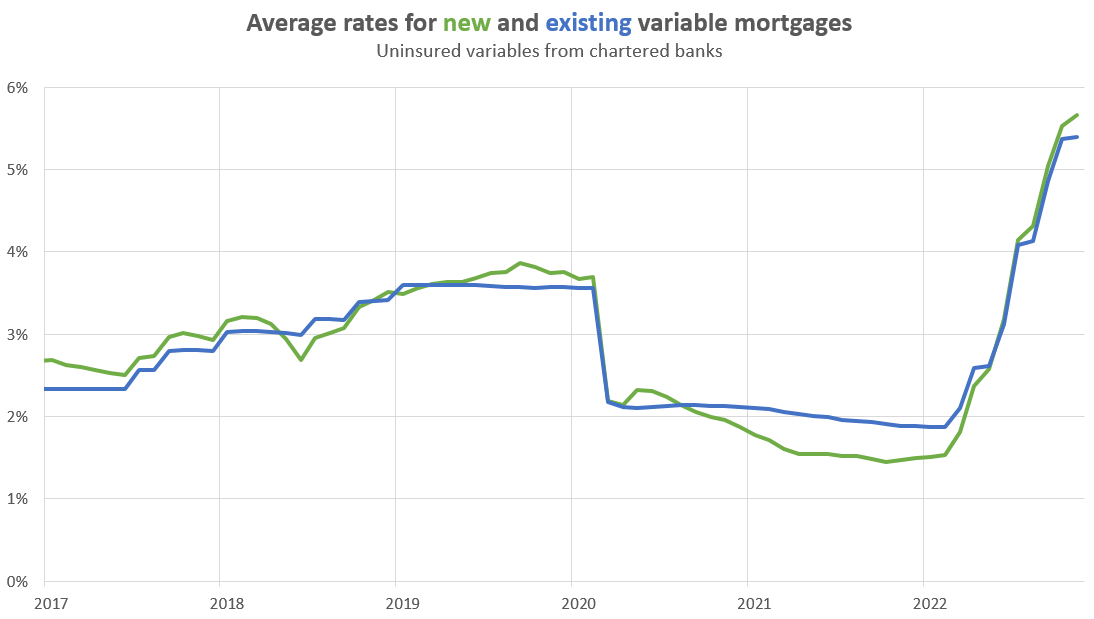

Changing Rates And The Market House Hunt Victoria

Non Conventional Mortgage Moneytips

Fha Vs Conventional Loan These Charts Can Help You Determine Which Is Cheaper

Non Conforming Loan Complete Guide On Non Conforming Loan

.png)

July 26 2021 Esipitch

Non Traditional Mortgage Options In 2021 Mashvisor

Non Conventional Mortgage Moneytips

Non Conventional Mortgage Moneytips

Non Traditional Mortgage Options In 2021 Mashvisor

Gary Wellner Senior Loan Officer Nmls 423697 Guild Mortgage Linkedin

The Pros And Cons Of Non Conforming Mortgages National Cash Offer

What Is Fannie Mae Purpose Eligibility Limits Programs